In any crisis, “playing it safe” to avoid losing your money can seem like the only rational strategy. However, in the past 60 years, we’ve seen repeating patterns of crises. Despite these crises, the market has been resilient. The Dow Jones Industrial Average rose from 679 points in 1959 to over 36,000 in January 2022.* Regardless, of the type of crisis, history shows that long-term investors who stayed the course through crises and didn’t lose sight of their financial goals have been rewarded.

First, Stress, Anxiety, and Crises

When crises hit, news ratings surge. For example, in the early days of the global pandemic, from March 16-20, 2020 Fox News saw its ratings climb 89% over the same time last year, while CNN was up 193%, and MSNBC climbed 56%.1

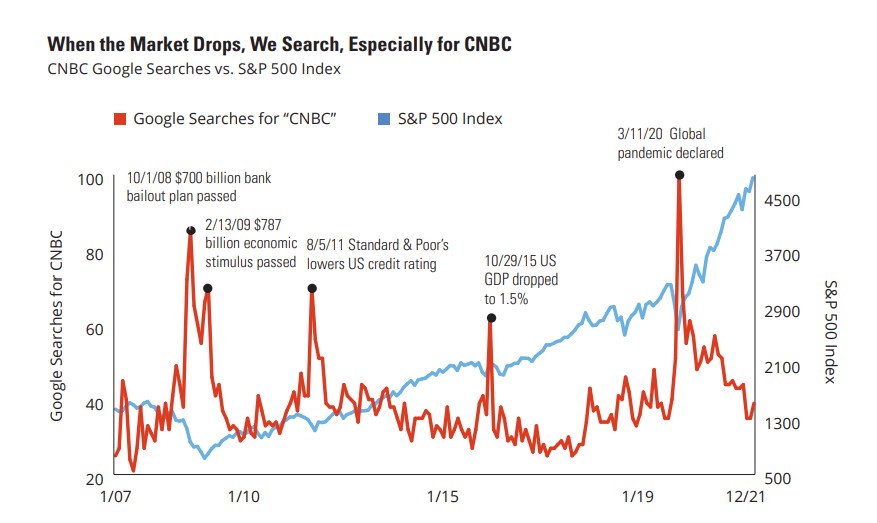

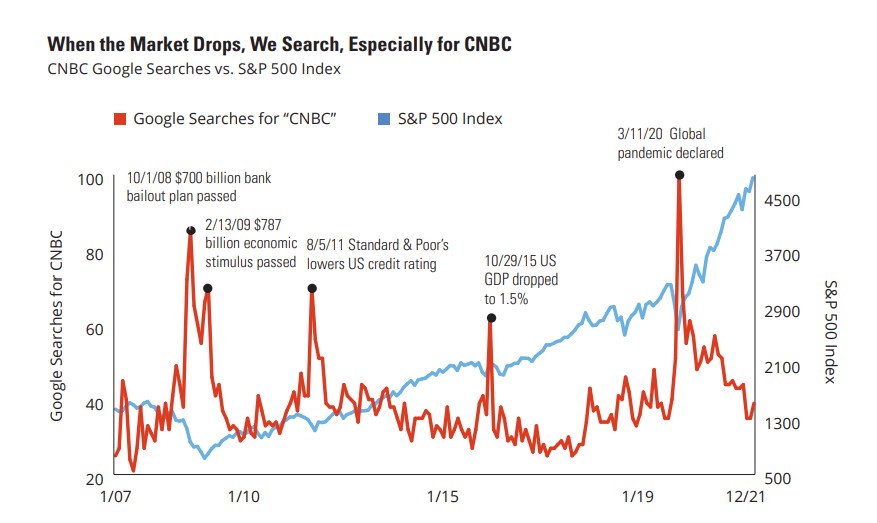

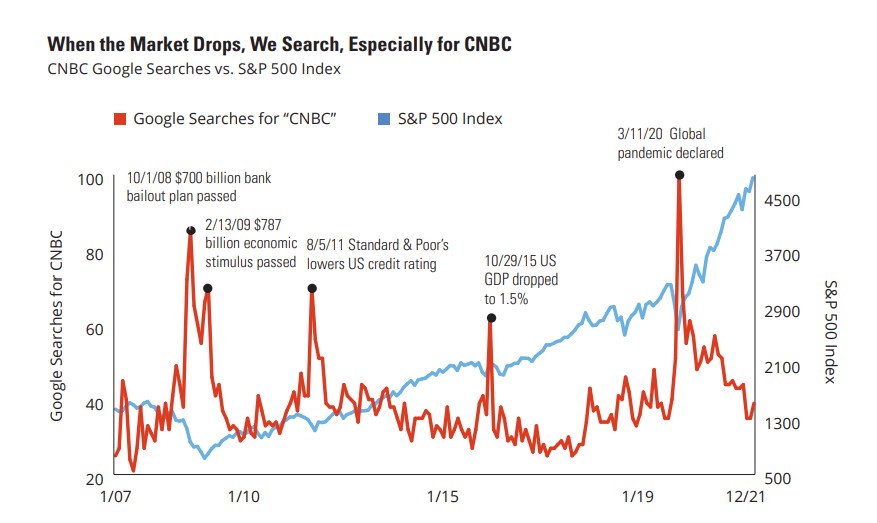

In addition to more news consumption, we’re searching CNBC more often to see how the market is performing. All this news watching and Googling can make us more anxious about the economy.

When we’re anxious, we’re more likely to allocate our attention to negative information.2 Given the choice between information that may offer an optimistic perspective or data that paints a bleak future, an anxiety-influenced investor may naturally focus on threatening information.

This is a study of Google searches for “CNBC” compared with S&P 500 Index performance. The blue line represents the S&P 500 Index and the red line represents Google searches. Do you see a pattern? There’s a correlation between poor market performance and CNBC searches. Past performance does not guarantee future results. See below for index descriptions. For illustrative purposes only. Indices are unmanaged and not available for direct investment. Source: Google Trends/Factset, 12/21

Second, The Risk of Mistakes

Let’s face it, there are good reasons to be anxious about a crisis’ effect on our economy. When anxiety increases, many investors respond by trying to make their portfolios safer. By the end of 2021, total assets in cash investments reached an astounding $17.2 trillion.3 Cash investments may provide a sense of security because of their perceived benefit of principal stability.

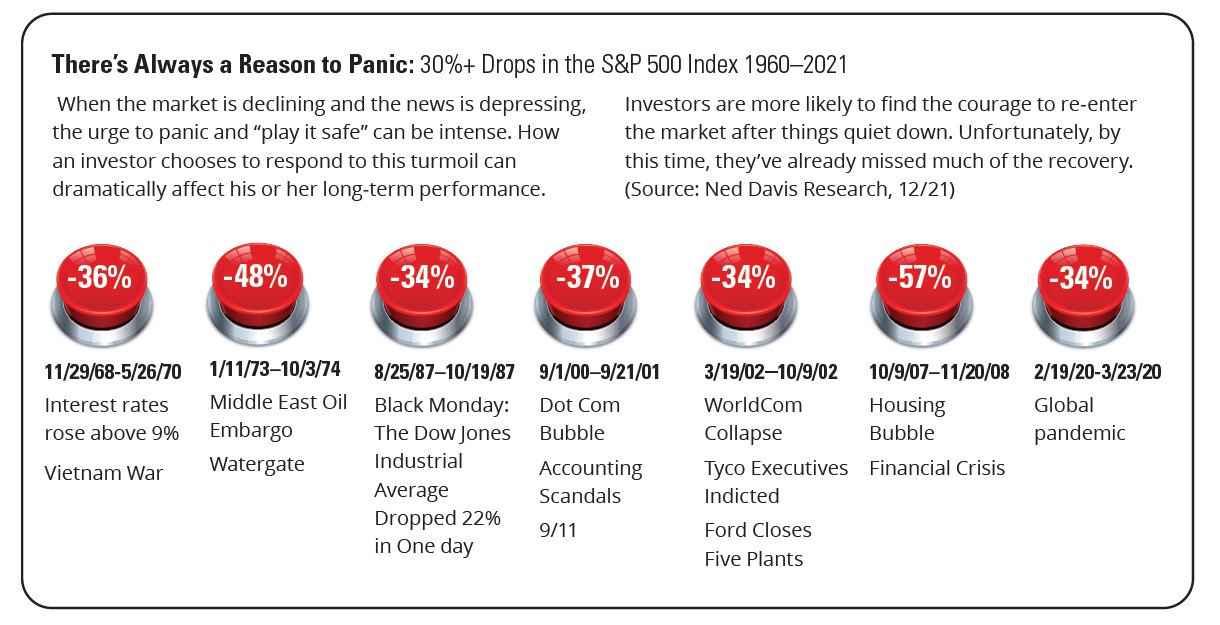

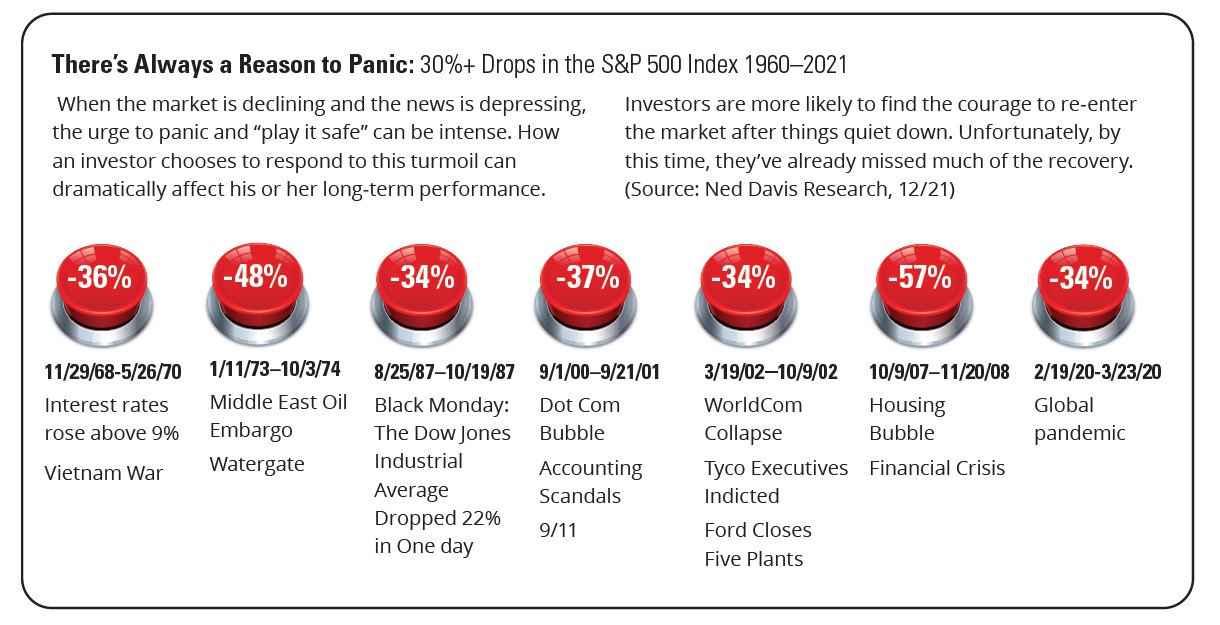

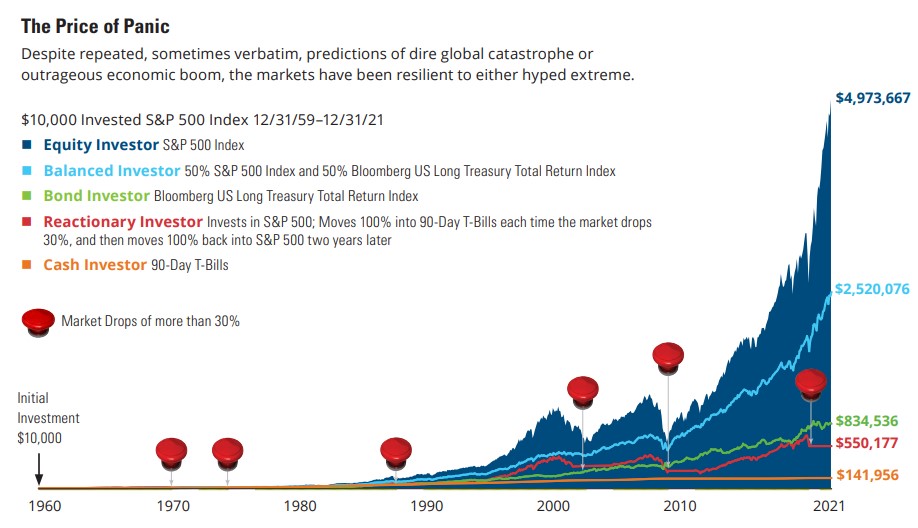

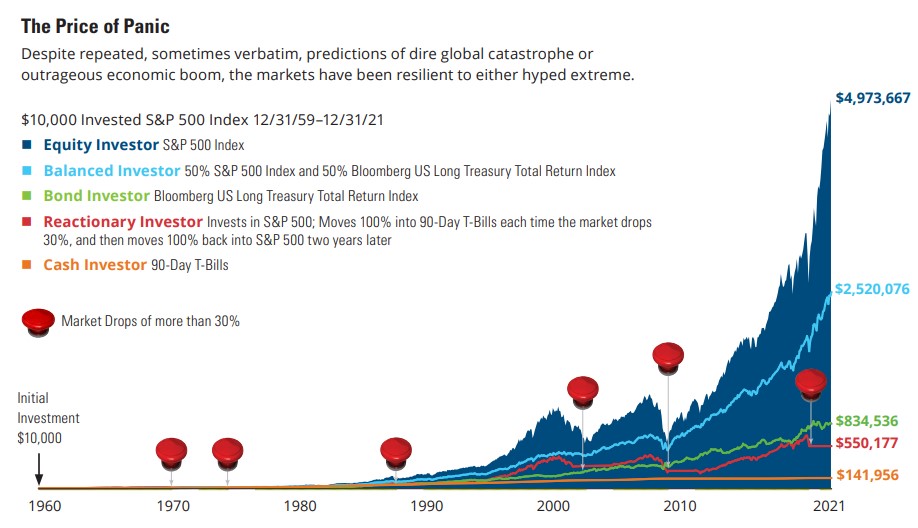

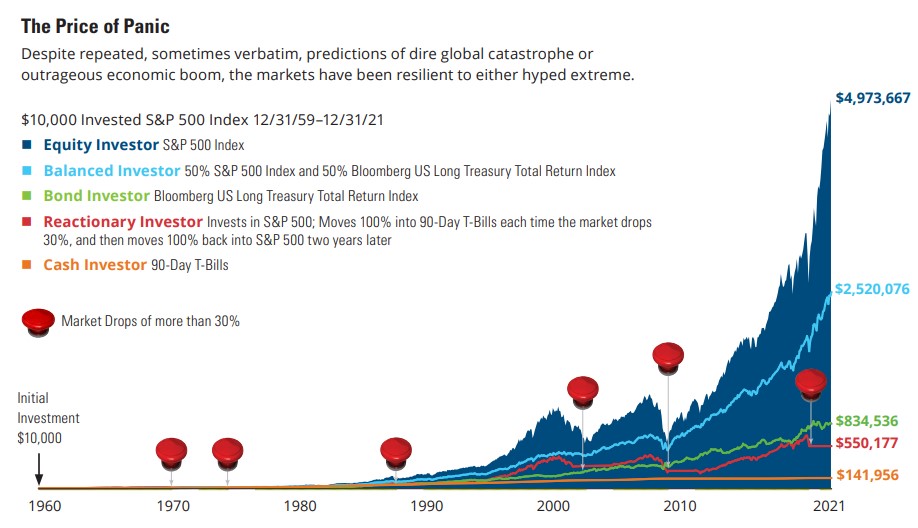

Making a portfolio safer seems perfectly rational during a crisis. Nobody likes losing money, especially when the market plunges. The pain of losing money is psychologically about twice as intense as the pleasure of gaining it.4 When the market drops 20% or more, that pain and temptation to make a portfolio safer can intensify. Since 1960, the market dropped more than 30% seven times.

Although safer investments can calm our anxiety when the market’s tumbling, choosing safety can be a mistake for long-term investors. The graph below illustrates how a hypothetical “reactionary” investor, who made their portfolio safe when the market dropped 30%, missed gains time and time again during market recoveries. The reactionary investor traded long-term results for short-term comfort.

The combination of market volatility and the constant drumbeat of negative news can make it difficult to stay calm—even for experienced investors. But giving in to panic by making abrupt changes to your portfolio could be detrimental to your long-term investment returns. Past performance does not guarantee future results. Equity returns are represented by the S&P 500 Index. Bond returns are represented by the Bloomberg Long-Term US Treasury Total Return Index. Reactionary returns indicate the results of an investor who invested in S&P 500 Index, moved 100% into 90-Day T-Bills each time the market dropped 30% and then moved 100% back into S&P 500 Index two years later. Balanced returns are represented by 50% S&P 500 Index and 50% Bloomberg Long-Term US Treasury Total Return Index. Cash returns are represented by 90-Day T-Bills. Data Source: Ned Davis Research, 12/21. For illustrative purposes only. Indices are unmanaged and not available for direct investment.

Third, Maintaining Perspective in Crises

Nobody likes to go through a crisis alone. Trying to manage your investments by yourself in a crisis, with extreme market volatility, can be mind-boggling. In March of 2020, the market dropped several times between 6–12% a day in both directions. One day the Dow Jones Industrial Average was down 2,000 points and a few days later up 2,000 points. It can be unnerving to hear “worst day ever” and then “best day ever” in terms of market point moves.

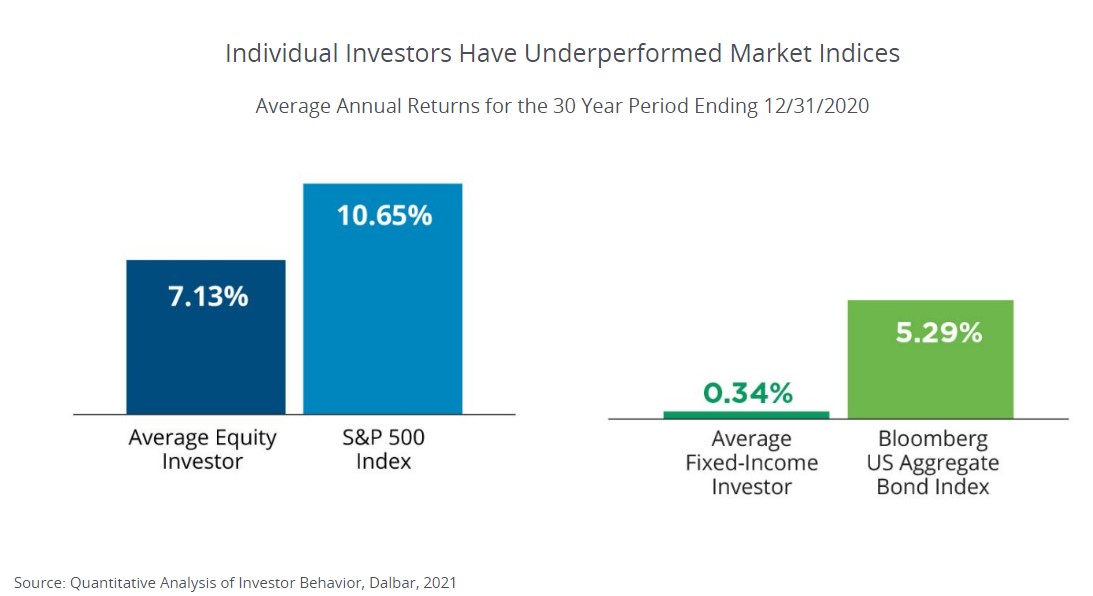

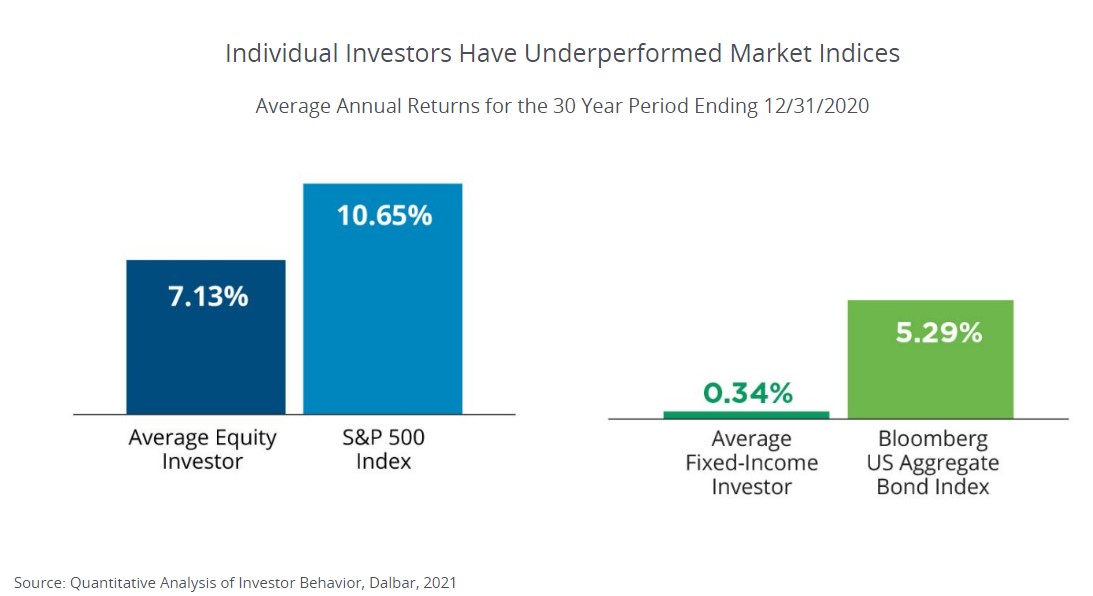

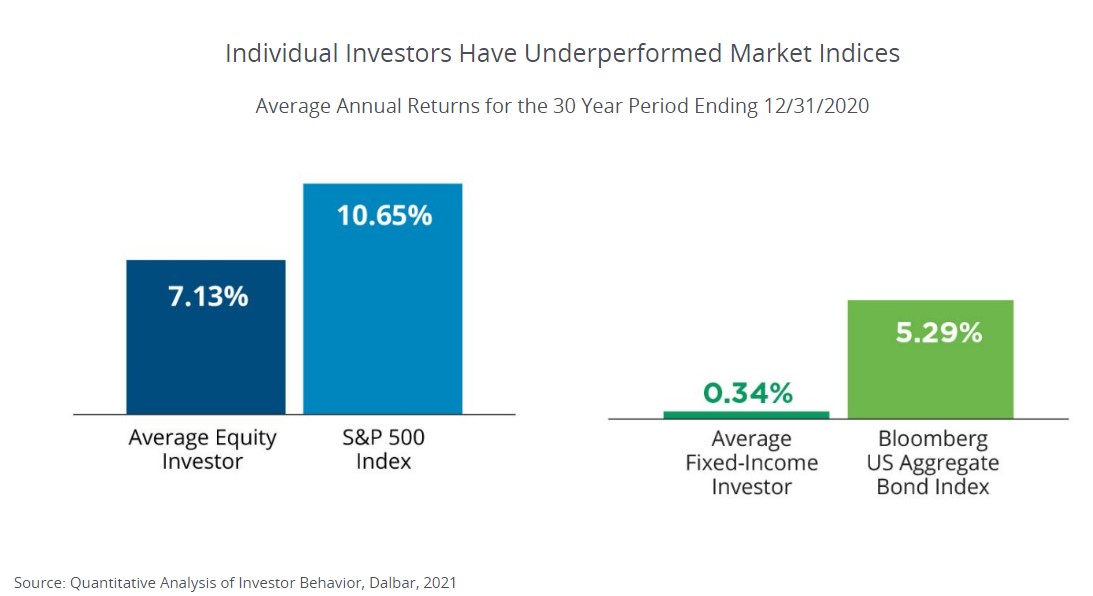

Many investors try to time the market’s ups and downs and change their portfolio investments accordingly. Research shows that this strategy hasn’t worked well for investors. Dalbar’s Quantitative Analysis of Investor Behavior studied has measured the effects of investor decisions to buy, sell, and switch into and out of mutual funds over short and long-term time frames. The results consistently show that the average investor returns are less—in many cases, much less—than market indices return.5

Hopping in and out of investments to prevent losses or capture gains can be a primary reason why investors have underperformed the market. Anxious investors tend to overestimate the risk of holding stock investments and underestimate the risk of not holding them. Over the past 30 years, as shown in the graph below, individual investors underperformed equities (as represented by the S&P 500 Index) and bonds (as represented by the Bloomberg US Aggregate Bond Index).5 The bottom line: investor behavior can determine success more than investment performance.

That’s why it’s important to have the support of a financial professional who can help you control impulsive reactions to market volatility and practice disciplined investing. In addition to helping you find appropriate investments for your financial goals, your financial professional plays a more crucial role by acting as a counter to the market’s mind games that can tempt even experienced investors.

Past performance does not guarantee future results. Performance data for indices represents a lump sum investment in January 1991 to December 2020 with no withdrawals. Stocks are represented by the S&P 500 Index. Bonds are represented by the Bloomberg US Aggregate Bond Index. Indices are unmanaged, unavailable for direct investment, and do not reflect fees, expenses, or sales charges. Please see below for the calculation of the average equity and fixed-income investor.

“But It’s Different This Time”

Many feel that the current crisis is different than previous crises. It is. Every crisis is different. With all the news coverage, we can feel like today is bad and tomorrow will be worse. It’s easy to get overwhelmed with pessimism. But despite all the bad news, there’s amazing innovation taking place that won’t get media attention.

For example, a team of MIT scientists developed a new form of plastic that’s two times stronger than steel under load tests.6 The metaverse will transport users into imaginary worlds that may open up new markets in software.7 Devices may help patients with paralysis control digital devices with their thoughts.8 New electric, zero-emission, self-driving trucks are providing a clean, safe and efficient way to ship.9

The US has experienced 26 bear markets since 1929.10 Our recovery record? 26 for 26. While we can’t predict the future, as Warren Buffett has said, “It’s never paid to bet against America.”

Three Things to Remember About Maintaining Perspective

First, crises influence us to focus on the negative.2 The flood of 24/7 crisis news coverage can contribute to our anxiety about the economy. Second, anxiety makes us more vulnerable to making investment mistakes that can damage our long-term results. Third, consider working with a financial professional to help you maintain a long-term perspective through the crisis.

NEXT STEPS

Talk to your financial professional to hear their perspective on this crisis. If you don’t have one, consider finding one.

Sources

- Ratings Skyrocket for Cable News Amid Wall-To-Wall Coronavirus

Coverage, Newsweek, 3/23/20 - Fear, Finance, and The High Anxiety Client, MIT AgeLab, 2016

- Board of Governors of the Federal Reserve System (US), 2021

- What Is Loss Aversion? Psychology Today, 3/8/18

- Quantitative Analysis of Investor Behavior, Dalbar, 2021

- MIT scientists create a super plastic that’s 2 times stronger than

steel, Fast Company, 2/7/22 - 2022 will be the biggest year for the metaverse so far, CNBC, 1/1/22

- Synchron kicks off clinical trial on device that helps patients with

paralysis communicate, mobihealthnews, 1/29/21 - Einride launches autonomous pods and electric freight operations in

US, TechCrunch, 11/3/21 - Ned Davis Research, 12/21

This article is sourced from Hartford Funds Distributors, LLC, Member FINRA.