SECURE 2.0 Act: More Retirement-Savings Flexibility—But At What Cost?

Policy expert Jeff Bush says the new law furthers the ‘Rothification’ of the U.S. retirement system. Find out how Social Security shortfalls and tax policy changes could affect your retirement goals.

Key Takeaways

The SECURE 2.0 Act gives retirement savers—and their employers—more flexibility with withdrawal time frames, expenses savings can cover, and more.

The clock is ticking on Social Security’s long-term viability as the government grapples with funding issues.

Given potential tax code changes, allocating assets among different types of investment accounts with varying taxation is critical.

Retirement savers and plan sponsors are dealing with the legislative jolt of the retirement reform bill President Joe Biden signed into law in December 2022.

Noted Washington observer and policy expert Jeff Bush offered American Century Investments clients insights into ramifications of the new SECURE 2.0 Act that could affect them in a March 28, 2023, webcast. Enhancements in the law, Bush said, provide savers with more retirement planning flexibility. That’s especially important as the federal government grapples with looming Social Security challenges and tax-law changes that could occur in the next three years.

Investors and savers, he said, should have a basic understanding of these dynamics as they contemplate how to prepare for retirement.

Secure 2.0 Act Emphasizes Investing After-Tax Dollars

Bush calls the approach of the SECURE 2.0 Act, formally known as the Securing a Strong Retirement Act of 2022, a “Rothification” of the U.S. retirement system, a reference to increasingly popular Roth Individual Retirement Arrangements (IRAs).

Savers fund Roth IRAs after paying income taxes, unlike traditional IRAs funded with pre-tax dollars.

Retirees pay taxes on conventional IRAs when they withdraw funds, often many years later.

Qualified Roth IRA withdrawals, on the other hand, have no tax liability because savers pay taxes upfront. Bush said that’s why a debt-laden federal government has steered retirement savings in that direction.

“Quite honestly, it’s self-serving,” Bush said. “If it’s after-tax for retirement, the federal government gets to spend our money today rather than waiting 25 to 30 years down the road (for savers to pay taxes on retirement withdrawals).”

The SECURE 2.0 Act updates 2019 legislation that expanded employer-sponsored 401(k) retirement savings plans’ availability to more part-time workers. Other enhancements retirement savers will appreciate, no more age restrictions on IRA contributions, pushed-back age for required minimum distributions (RMDs) from traditional IRAs, and simpler access to annuities.

The new law provides further flexibility with the changes highlighted below.

Secure Act 2.0 Changes Phase-In Over Next Three Years

Effective 2023:

- Raises the age of required minimum distributions to 73 for people born between 1951–1959 and 75 for those born after 1960.

- Reduces the tax penalty for missing a required minimum distribution from 50% to 25% (10% if corrected promptly).

- Expands qualified charitable distributions with $50,000-lifetime maximum allocated to so-called “split interest entities,” such as a charitable gift annuity.

Effective 2024:

- Allows investors in 529 education savings plans to roll over up to $35,000 from their plan to a Roth IRA, subject to ROTH contribution limits of the beneficiary. The Treasury is working on additional clarifications between now and the end of 2023.

- Allows employers to create an emergency savings program for employees similar to a Roth IRA. Workers can contribute up to 3% of their salary, or up to $2,500 annually, with employers able to match the amount.

- Eliminates RMDs for employer-sponsored Roth 401(k) and Roth 403(b) plans.

Effective 2025:

- Allows $2,500 in penalty-free annual IRA withdrawals to cover long-term care insurance.

Social Security Funding Faces Big Unknowns

Considering the Social Security program’s challenges, increased options and flexibility for retirement savers appear paramount.

The government began drawing down Social Security trust funds in 2021, with the Social Security Administration now expecting those funds to run out in 2033.

At that point, Bush emphasized, Social Security would transition from an entitlement program to a “pay-as-you-go” system.

“An entitlement program means we’re going to pay the bill, whatever it is,” he said. “A pay-as-you-go program simply says that as $1 in tax revenue comes in, they can only pay $1 in benefits out. So, you can imagine the impact of that shift in the program if revenues aren’t sufficient to pay the current liabilities.”

The shortfall, Bush said, could decrease Social Security payments by 25% to 28%. It’s a staggering prospect — especially for the 73% of Social Security recipients whose payments represent their only source of income.

What Could Help Make the Social Security Program Solvent?

There are several ways to bridge the funding gap — increasing income tax rates, increasing the amount of income subject to Social Security taxes or eliminating early retirement eligibility.

But one popular option — raising the full retirement age from 67 to 70 — won’t work without other steps, Bush said.

“I’m here to tell you that won’t fix it,” he said. “You’d have to raise [the age] to 78, not 70. And oh, by the way, you’d also have to get rid of early retirement. So clearly, that’s not going to happen.”

The current congressional battle to increase the U.S. government’s debt ceiling has included some debate about Social Security. However, Bush said, “We’ll know they’re serious when they’re willing to address all the variables of the Social Security formula simultaneously.” And he doesn’t expect that to happen until later this decade.

Additional Tax Law Changes Ahead Complicate Matters Further

Meanwhile, the Tax Cut and Jobs Act of 2017 will expire at the end of 2025 unless it’s replaced.

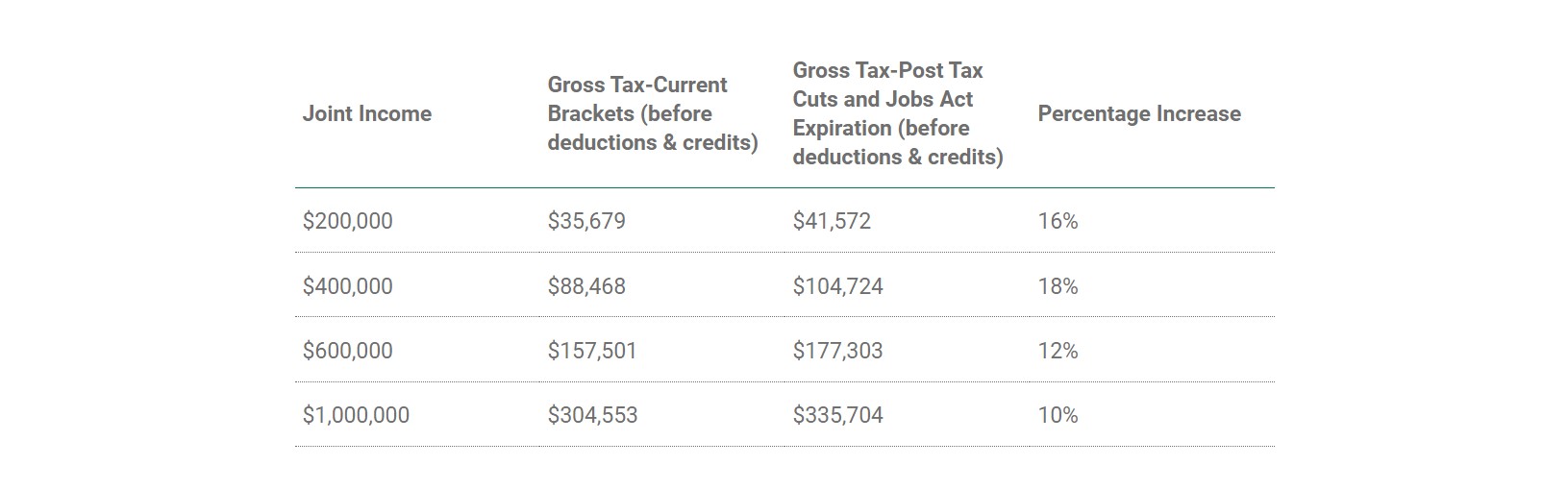

Among other outcomes, marginal individual tax rates would return to pre-2017 levels. The top marginal rate would revert to 39.6% from 37%, with tax brackets narrowing to expose more individual income to higher rates. Bush said workers earning $200,000 – $400,000 annually would face the most significant impact, with their taxes rising an average of 17%.

For retirement savers, capital gains taxes would remain at 20%. Still, whether the tax law will expire or what could replace it creates uncertainty.

Strategies That May Reduce Your Tax Burden

In the meantime, Bush suggests taking a closer look at converting assets to Roth IRAs. Additionally, now could be a good time to “overfund” 529 plans in advance of the new SECURE Act 2.0 rule starting in 2024.

He also emphasized the importance of diversifying tax exposure much like investors do with assets to address the probability of higher overall tax rates and tax volatility in the future. That means not having retirement assets in just one account with the same tax rate. Instead, savers could increase one-time charitable gifts or take other steps to diversify their retirement planning.

“One of my biggest fears for the average American saving for retirement is having 100% of their retirement saving in one place: a 401(k),” he said. “And if we think tax volatility is going to be higher in the future, that means their lifestyle’s going to have that volatility. Of course, none of us wants that when we retire.”

Other options, according to Bush, include incorporating tax-managed solutions such as annuities and life insurance into retirement savings strategies. He also suggests considering gifting assets to take advantage of the very generous estate tax exemption we enjoy today.

Fortunately, the SECURE 2.0 Act provides retirement savers with choices. And it’s those choices that may help support their lifestyles and mitigate risks from potential changes in tax policy.