AAFMAA Wealth Builder

AAFMAA Wealth Builder

Key Features and Benefits

What is Wealth Builder?

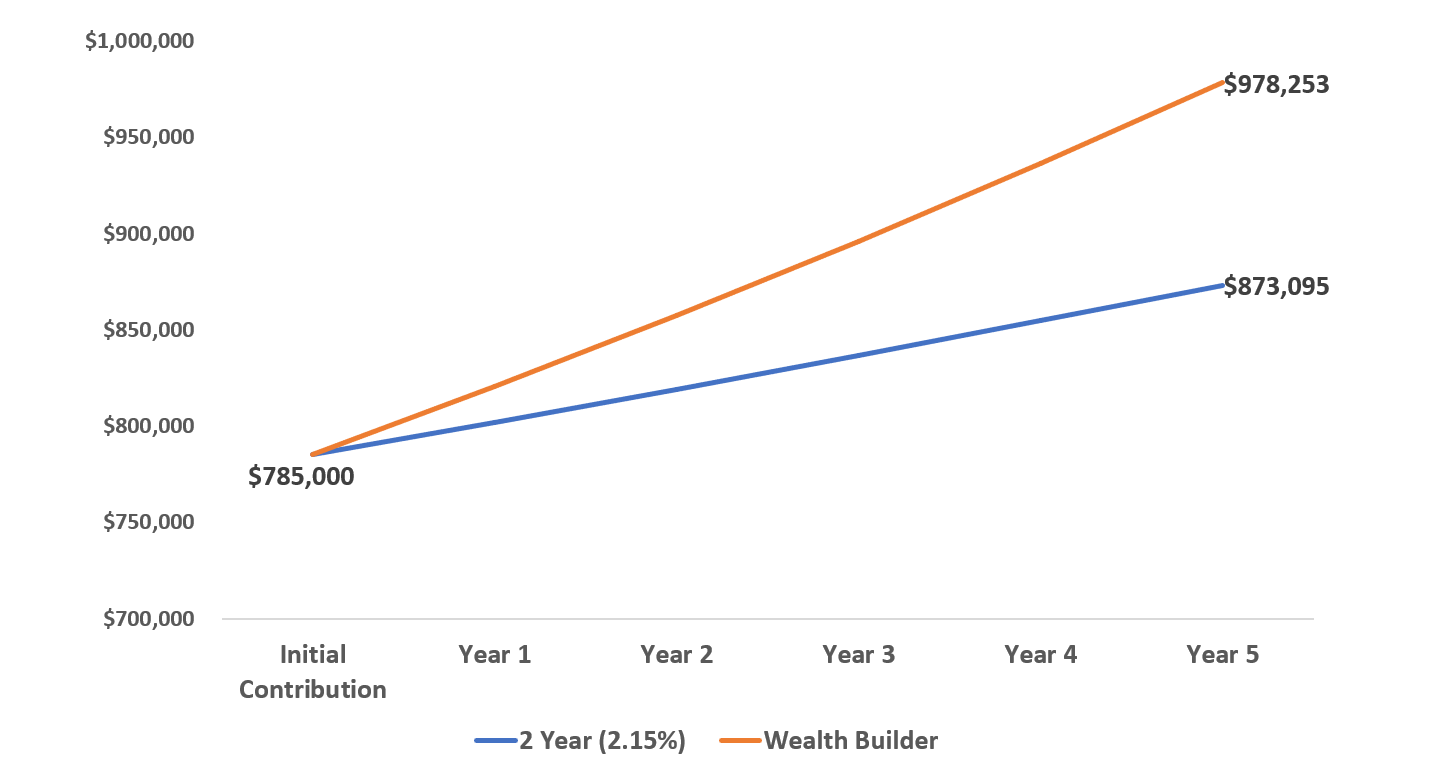

AAFMAA vs. 2 Year Annuity Growth

Your Client grows $105,158 more with AAFMAA in five years or 119% greater growth

Considering a Deferred Annuity? Wealth Builder is a Better Solution.

When investing in a life insurance plan, there are several types of deferred annuities to consider. A deferred annuity is a long-term investment in which you invest a sum of money now and receive payments after the initial sum has accrued interest over a period of time, typically years in the future. The type of deferred annuity you purchase—fixed, variable, indexed—will determine how the rate of return is computed.

While there are many benefits of tax-deferred annuities, once the policy is annuitized and the accumulation period ends, earnings in the deferred annuity become subject to taxation. This applies to both individual annuities and joint and survivor annuities.

One significant benefit of AAFMAA Wealth Builder Life Insurance is that all policies are Modified Endowment Contracts (MEC). A Modified Endowment Contract is a tax qualification of a life insurance policy where premiums are paid into a life insurance policy more quickly than normal, usually less than seven years. Since MECs grow tax-deferred and have a tax-free death benefit, they are seen as a beneficial alternative to traditional deferred annuities.

Value-Added Additions

Who is Eligible?

AAFMAA Background

Want to know more about AAFMAA Wealth Builder?

Download the full brochure here

Disclaimer

*MEC definition, crediting rate includes 0.75% administrative fee

AAFMAA Wealth Builder Life Insurance is a life insurance policy. This is not a federally insured savings deposit and should not be purchased for that purpose. Includes a Long-Term Care Settlement Option. For more information, visit aafmaa.com/wbli.

Subject to terms and conditions of the policy, including exclusions and limitations. There is no insurance coverage unless you apply and are accepted by AAFMAA, a policy is issued and you pay the required premium. No war, aviation, terrorist clause. All policies include Survivor Assistance Services.

*AAFMAA’s current crediting rate on Wealth Builder Life Insurance policies issued in 2021 is 4.50%, minus an administrative fee of 0.75% for a net current return of 3.75%. These rates are NOT guaranteed. The guaranteed crediting rate for Wealth Builder Life Insurance policies issued in 2020 is 3.0%, minus the administrative fee for a net guaranteed return of 2.25%.

Wealth Builder Life Insurance policies are Modified Endowment Contracts (MECs) subject to the Technical and Miscellaneous Revenue Act of 1988 (TAMRA). Under TAMRA, you may owe taxes and penalties if you surrender or take a loan against the cash value in your Wealth Builder Life Insurance policy. AAFMAA does not provide tax advice. If you have questions about the tax implications of this product or other life insurance products you own, please consult a qualified tax professional.

The U.S. Government does not sanction, recommend, or encourage the sale of this product. Subsidized life insurance may be available from the Federal Government.

***Minimum contribution of $7,850 per policy, maximum of 100 policies per person.